Conversion Optimization: It’s All About Action

Mar 21, 2010 Optimization, Statistics, Web Analytics

Optimizing your website to maximize the number of page views or visitors, while sounding reasonable, may unwittingly have you wasting marketing dollars and effort on people who won’t buy anything or participate on your website (or your advertisers’ websites) in the foreseeable future.

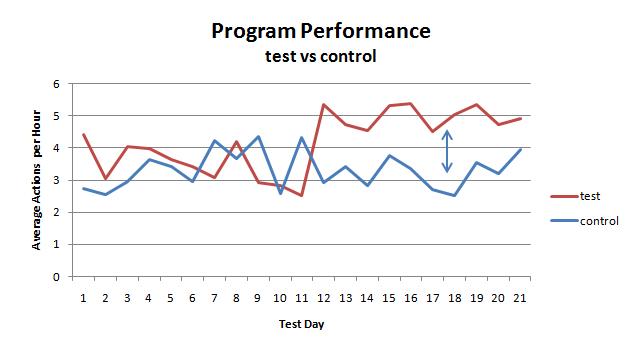

When you spend time and money on your site content or on audience development for your site, you want to make sure you are measuring the impact of those changes in terms of number of desired actions taken by visitors to your site, in terms of the efficiency with which you are spending resource. The key measure you are tracking on the cost side is the ECPA, or effective cost per action. If you have a small site and are passive about audience development, perhaps it makes sense to optimize to Actions Per Visit (APV), or Actions Per Daily Unique visitor (APDU). But if you are spending serious time and money then you need to track these costs and what they generate.

Lights! Camera! Actions!

Before this kind of thing makes any sense at all you have to define and start measuring the on the kinds of action you are trying to get visitors to take. Are you selling things? Are you getting paid for advertising shown on your site? Are you trying to develop leads for your business? Are you trying to get people to download something? Are you trying to get people to register or sign up? Whatever actions you want people to take on your site, they need to be measured if they are going to be the basis for your ECPA (or APV, APDU). Most of these things can be measured using Google Analytics.

In any case, once you have tagged or otherwise instrumented your site to capture your desired actions, then you can track ECPA (or APV, APDU) associated with your site.

Then when you make big changes, you can see whether they improved your site’s performance. You can measure the effectiveness of your SEM, your CPC campaigns on search engines, your affiliate programs, and your efforts to publicize your site.

Measuring Dollars Out per Dollar In

ECPA is a pretty good measure, but, it only measures efficiency on the cost side. You also want to measure the return you get in dollars and cents. You can do this (or approximate this) if you can come up with a dollar value for each of your site’s target actions, either using an average value per action type or actual value per action, then you don’t need the oversimplification that focusing only on ECPA imposes. Simply put, all actions on your site are not worth the same amount and it actually makes sense to spend more on actions that are worth more. What you really ultimately want is an ROI. I’ll talk about that in a later post.

Tags: Conversion optimization, Cost per Action, CPA, eCPA, Optimization

Math Marketing: Excellent White Paper by Dimitri Maex

Mar 15, 2010 Industry News, Marketing And Advertising Analytics, Optimization, Statistics, Web Analytics

Dimitri Maex is the Managing Director Marketing Effectiveness at Ogilvy & Mather, and the author of a fantastic white paper that is posted HERE on the WPP website . What is so great about it is that it presents exactly what most companies need to know in order to get started in harnessing the full power of quantitative marketing methods, in a package that only takes about 15 minutes to read.

He starts with the history of quantitative marketing, gives a sense of the place of “math marketing” in the current business landscape, describes the types vendors with which a company can ally, and the wraps up with how a company should organize and hire to around the new skills and challenges peculiar to the coming era of quantitatively-driven marketing.

Some nits:

I don’t like the sound of the name “math marketing”. It’s just that the math doesn’t do any marketing – people still make the decisions and integrate the insights into their work, they just use data-based metrics and statistical techniques to assist them in getting a coherent picture of what is working and what isn’t, and formulating what might work in the future. It is probably also a terrible way to brand something you are selling to execs who mostly sucked at and avoided math in school. It’s like calling it “eat your vegetables marketing”.

The section on vendors is far from exhaustive. He leaves out SEM/SEO agencies in particular, and provides only the massive brand names in most of the categories he is describing. I guess Maex works for an ad agency – so he’s not responsible for selling you on his competition – but I’d look elsewhere for a buyer’s guide.

Whatever, he is right on the money about the current state of affairs and where most companies need to go.

He wraps with a couple of lists: Seven Steps to Increased Accountability, and Seven Steps to Increased Accountability to Transformational Consumer Insights.

This is a great document for business folk who want to understand the big picture of marketing analytics and quantitative marketing techniques, and want to understand how to manage them to best effect.

Tags: Data Mining, Dimitri Maex, Doubleclick, econometric models, Google Trends, Marketing Analytics, marketing mix models, Math Marketing, Microsoft, Ogilvy & Mather, quantitative marketing

If Congress Thinks Cookies Violate Your Privacy, Wait’ll They Hear About This!

Feb 24, 2010 Industry News, Web Analytics

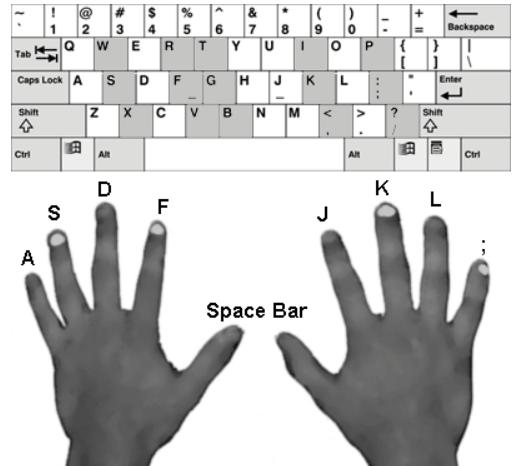

If you were to go to the Scout Analytics website dig into the info about their offerings, you’ll find that they tested their patent-pending technology for the last six months on hundreds of thousands of users (see the Press Release entitled “Scout Analytics(TM) Quantifies the Inaccuracy of Cookies as a Measure of Unique Users‘) The two techniques they cite as the basis for this study: biometric signatures and device signatures. The release is more revealing about the biometric approach than it is about the device signatures. The biometric signature is essentially an identifiable pattern in a person’s typing style. The device signature is something they are vaguer about, saying only it is based on “data elements collected from the browser to eliminate errors in device counting such as cleared cookies”. The test was meant to see not only how much overcounting of unique users there was, but how many unlicensed users there were of subscription content via multiple use of the same user account.

I wonder if they got the explicit permission of the subscribers to have their keystrokes and machines profiled? If this kind of approach were to spread beyond detection of licensing violations, I wonder how much sympathy regulators and legislators would have for it?

Tags: Behavioral Targeting, Cookies, Keystroke Profiling, licensed content, Machine Profiling, Scout Analytics, site visitor identification, unique visitors, web

The Cookie vs. The LSO – Should I Care? Should I Worry?

Feb 18, 2010 Industry News, Web Analytics

Here’s a question that savvy web users were being asked by their parents 10 years ago:

What the heck is a cookie, and why do I have them on my computer? Do I need to delete them? How do I delete them?

Don’t be surprised if the question starts to come up again, in a new form:

What the heck is an LSO, and why do I have them on my computer? Do I need to delete them? How do I delete them?

The issue is emerging again because of the people in the business of targeting ads or offers are trying to do their job better, and cookies are not doing the job advertisers want done. So, some web programmers are exploiting a feature of Flash to create “stealth cookies” called LSOs, in hopes that you won’t delete them because you probably don’t know how.

Remind me: What is a cookie again?

A cookie is a small text file that is created via your browser to keep track of session “state” and historic entries and site activity.

What is a cookie for?

The connectionless protocols used by the web do not automatically keep track of any history. If there is no state or history information provided with a page request, then the page will have no idea who you are, even if you just entered that info on a different page in the same site.

What’s so scary about that? Well, people just don’t like their activity being recorded without their permission or awareness. It annoys them. That said, there are useful things that this kind of snooping makes possible:

At the same time, it makes possible:

Cookie Deletion

When many people figured all this out it became a big kerfuffle, and this led to user behavior such that 23% of all cookies are deleted when they are one week old, and that less than half of all cookies (43%) live to be more than eight weeks old (click here to see Microsoft research about cookie deletion). Users can use functionality in their browsers to delete cookies and to control cookie-related policies within the browser.

So who cares? What problems does cookie deletion cause?

If you are an internet advertiser, it adds one more layer of complexity to the already difficult problem of tracking internet ad campaigns. You’ll have tracking pixels in ads to capture views and clicks, but knowing how many times someone has seen an ad during a campaign (frequency) and how many distinct individuals have seen an ad (reach) is pretty critical to understanding what is going on in a campaign, especially as more brand advertising comes online. Measurement is made difficult in internet advertising by these factors:

Net/Net: Bad Measurements

On balance, these issues push the measurements in the direction of overcounting reach and undercounting frequency.

Some of the other deficiencies of cookies from an advertiser point of view are that cookies don’t store very much information (4KB), and there can only be so many cookies related to a given domain (20). Privacy considerations additionally limit how much cross-site behavior can be captured in cookies (and banner campaigns are cross-site, mostly).

LSOs Addess Some of These Shortcomings For Advertisers (Yay!), But Create New Ones for Users (Boo!)

An LSO (Local Storage Object) is a cookie-like file that Flash uses to store information for Flash applications. Except that they are used by clever web programmers for far more than that – they are used by some sites just like really big cookies (as much as 25 times bigger than a cookie) that you don’t know about and so won’t delete. In addition, the same LSOs are accessible from all browsers. Your browser security controls have little or no impact on these things.

You Might Want To Check Your Computer For LSOs Right Now

If you don’t believe me, go to the Macromedia page that lets you see what LSOs are on your machine (it also lets you delete them, enable/disable them, and control their behavior).

It is located here: http://www.macromedia.com/support/documentation/en/flashplayer/help/settings_manager07.html.

While you are there, delete the ones for sites you don’t want your boss to know about.

As for where this is all going, all privacy loopholes on the web are temporary, and there are already browser add-ins that let you control and delete LSOs, and at some point the browsers will absorb that functionality to make it easy for you to use. If I were you, I’d worry more about the things you can’t see: The new keystroke dynamics technique for identifying users announced by Scout Analytics (here) and backend ISP- and CDN- based tracking – all these are fodder for more paranoid posts in the future.

Tags: Analytics, banners, Campaign Analytics, Cookies, Flash Cookies, frequency, Internet Advertising, LSOs, marketing, Media Measurement, Privacy, reach, Security

Facebook Dominates Social Media Searches (Yet More Fun With Google Trends)

Jan 4, 2010 Industry News, Web Analytics

Playing with tools is fun – I did another Google Trends search, this time comparing “Facebook” to “MySpace”, “YouTube” and “LinkedIn” as reference points. Wow – searches for “Facebook” have really grown amazingly fast (see the first chart, below). I wish I had bought a piece of that company 2-3 years ago.

It occurred to me that there should be a corresponding trend in searches for “social networking”, relative to other online marketing activities (e.g., email, search, display advertising). Searches for “social networking” have had a huge growth rate, but the absolute volume turns out to be really small compared to “email” and “search”. I guess there is still time to get on that bandwagon. The search volume for “Facebook” crushes that for those terms, but this is made harder to interpret by the fact that these are much more likely to be searches by users, not just marketing professionals.

Tags: Bill Seely, Facebook, Google Trends, Graph, Keyword Search Frequency, Practical Marketing Analytics, Social Media

Search Volume for Analytics Ramping Up Steadily – (More Fun With Google Trends)

Jan 4, 2010 Industry News, Marketing And Advertising Analytics, Statistics, TV and iTV Analytics, Web Analytics

Just for fun, I did another Google Trends search, this time on “analytics” – adding “CRM” and “ERP” as reference points. The result seems to suggest that if you are in the business software market, that you should have an analytics offering. We’ll see, but I predict that the hot growth area in business software in 2010 will be Analytics. Searches for analytics have been steadily ramping up for the last several years, and are now at a higher level than searches for the above-mentioned enterprise business software categories.

I find it very interesting that searches for “ERP” and “CRM” have been flat for so long, but REALLY interesting that the volume of “analytics” searches surpassed them in 2009.

Tags: Analytics, Bill Seely, CRM, ERP, Google Trends, Graph, Keyword Search Frequency, Practical Marketing Analytics

New Partnership Measuring Online Ad Impact on CPG Sales: IRI, Comscore, AOL, [x+1], and Dynamic Logic

Dec 21, 2009 Industry News, Marketing And Advertising Analytics, Web Analytics

A recent spate of press releases (HERE, HERE, and HERE, among others.) announced a partnership that will offer measurement of online advertising’s sales impact for consumer packaged goods companies. What does this mean to online content providers, agencies and ad networks? If there is a credible way of measuring the impact of online advertising on the sales of snacks, beverages, health and beauty aids, OTC pharmaceuticals and household products, this will unlock huge CPG money that has been held back from full adoption of online advertising because of uncertainty about its relative effectiveness compared to channels CPG companies have used for decades. Did I say “huge money”? I meant to say HUGE MONEY.

This will ultimately have a secondary effect that is good for the analytics business – it will raise the bar. CPG companies have long used analytics to plan and measure impact for their media spending, and as a result, they are data and modeling savvy. They will not blindly accept whatever someone pulls from Atlas, DoubleClick, Google Analytics, Omniture or WebTrends. The CPG paradigm is one where the cross-effects and tradeoffs between different media channels are measured and modeled, and nothing gets the big spend unless the numbers support it. This goes way beyond just throwing some tags in some ads and counting impressions, clicks and conversions. This entails starting with capture of how marketing dollars are spent, and then modeling how the spending does or does not move total sales (not just the sales from online). Things are about to get even more interesting.

Tags: [x+1], AOL, Bill Seely, Comscore, Dynamic Logic, Information Resources, IRI, Practical Marketing Analytics, press release

Coalition for Innovative Media Measurement – the CIMM – Gets Launched

Nov 2, 2009 Industry News, TV and iTV Analytics, Web Analytics

The Coalition for Innovative Media Measurement (the CIMM) launched their website last week (http://www.cimm-us.org). Members in the coalition consists of TV programmers, advertisers, and ad agencies. While AT&T is represented, it is their Brand Marketing and Advertising SVP who is sitting on the council.

The CIMM released two research RFPs on their site last week. The two areas for investigation:

1. Investigate the current and future potential of TV measurement via set top box data

2. Cross-platform measurement of video across Television, Internet, and Mobile

This may sound simple, but don’t let the short sentences fool you. The first one alone is loaded with gotchas that will make responders think twice. First of all, they have to be the first of the set-top box vendors willing to be completely transparent with their data and their processes. This is unlikely to be undertaken by an operator for the usual price of a research study.

Who knows? Maybe I am wrong and one of them will step up in order to get first-mover advantage in the data-vending business. Maybe AT&T will get pulled in because of their participation in the council. The reason I am skeptical is that the operators are unlikely to arm programmers with better information to use against them in negotiations around carriage fees etc. without getting a really huge concession or advantage in return. Perhaps it might make more sense for a company like TiVo to participate than it would for a cable, telco or DBS operator.

As someone who wants access to the information, I hope I am wrong and would love to be proven so. We’ll see.

Tags: AT&T, CIMM, Coalition for Innovative Media Measurement, cross-platform, data, Kantar, MEDIAWEEK, Metrics, multiplatform, Practical Marketing Analytics, Seely, set-top box, three screen viewing, video

Forrester Publishes Evaluation of Interactive Attribution Vendors: ClearSaleing, Visual IQ, And Atlas Lead, With [x+1] And Coremetrics Close Behind

Oct 21, 2009 Industry News, Web Analytics

I was just looking at the summary of the new Forrester report comparing interactive attribution vendors. My old friends at [x+1] are in the mix, even stacked up against players like Atlas, ClearSaleing, Visual IQ and CoreMetrics – despite the fact that attribution is not mainly what they do. They do it because it needs to be done well in order for them to deliver on their core competency, which is using industry-leading optimization of performance for online media and websites. Attribution is critical to optimizing media and site performance because you need an objective function (a numeric “score”) to optimize or even improve: attribution is how you keep score. Attribution is the process whereby credit for a conversion (a goal action, like a sale, subscription, or lead) is allocated among the many marketing activities and actors selling that product or service.

Historically, 100% of the credit for a sale has been attributed to the last online marketing “touch” before a purchase was made, in more or less this way:

1. All touches (impressions, clicks, conversions) needed to be tracked in the same system to be “attributable”

2. When a goal action occurred, the database was searched for the most recent impression with a click. If one is found, then it got attributed “credit” for the goal action. This is what is sometimes referred to as a “clickthrough conversion”.

3. If the whole attribution window (the time frame for which impressions are considered eligible for attribution) is searched and no click is found, then the most recent impression is found, and assigned (usually partial) credit for the conversion. This is sometimes referred to as a “view-through conversion”.

The new paradigm in attribution, represented by the offerings of the firms reviewed in the referenced Forrester paper, involves the effort to model, understand, and optimize the sequences of marketing activities that touch a prospective customer. Each of these “touches” is seen to have potential influence on the ultimate outcome (conversion vs. non-conversion), and the solutions here are ways of assigning a value to the contribution of each interaction. Some approaches to doing this are built upon models of the buying process, others are more brute force. Some vendors offer this as an approach for marketing mix allocation, others are more focused on banner, search, and site optimization.

If all this sounds fun and interesting to you, then you must be in analytics. Otherwise, the takeaway for you will just be this: better ROI (and better ROI measurement) from online marketing activities.

Tags: [x+1], Atlas, Attribution, attribution window, Bill Seely, ClearSaleing, click, clickthrough, conversion, CoreMetrics, Forrester, Practical Marketing Analytics, viewthrough, Visual IQ